Financial Performance and Strategy

, led by , announced a significant drop in first-quarter earnings, with a $12.7 billion profit, down 64% from a year ago, attributed to a decrease in the paper value of investments and a partial sell-off of its holdings.

Despite the decreased profit, Berkshire's operating earnings rose 39% to $11.222 billion, outperforming analyst expectations. The conglomerate maintains a robust cash position, with holdings expected to reach $200 billion by the end of Q2.

Leadership and Long-Term Investments

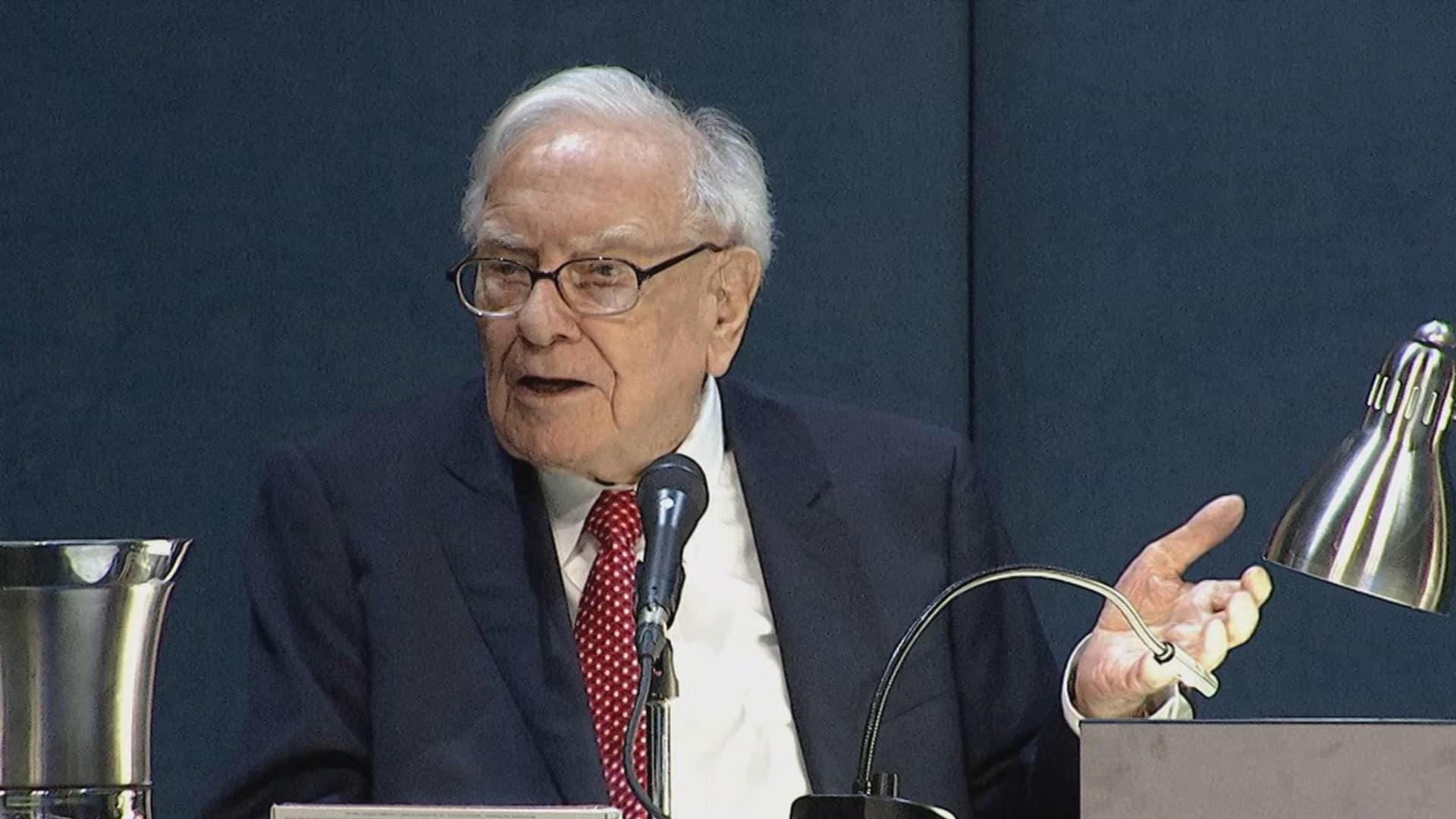

Warren Buffett emphasized that Berkshire still regards Apple as a top investment, even after reducing its stake by about 13% in the first quarter. This move was part of a broader strategy to maintain ample liquidity for future opportunities.

The annual shareholders meeting, often dubbed 'Woodstock for Capitalists', carried a somber tone without , Buffett's longtime partner, who was commemorated with a tribute. Buffett discussed succession planning and expressed confidence in , his designated successor.

:max_bytes(150000):strip_icc()/GettyImages-13946501421-8dbc5799733c44daaa3ac8bdb8f18fec.jpg)